Free documentation

By entering my data and pressing the “Send” button, I declare my consent to my contact details being used to respond to my enquiry. I can revoke my consent to the collection of personal data collected during contact at any time

Switzerland is known for its high standard of living, discretion, security and low taxes. You can benefit from this by domiciling your company in Switzerland. We support you with the foundation or relocation of your company and provide offices and company addresses.

By entering my data and pressing the “Send” button, I declare my consent to my contact details being used to respond to my enquiry. I can revoke my consent to the collection of personal data collected during contact at any time

Domizil4u offers you business premises and c/o addresses (letterbox companies) in prime locations in all low-tax cantons in Switzerland.

Domizil4u advises you quickly, professionally and inexpensively in legal and tax matters with its own notaries and lawyers.

Ddomizil4u carries out the notarisation of the foundation or the relocation of the registered office and the registration with the commercial registry office for you.

Ddomizil4u takes over the entire administration of your company for you.

We are offering our services for legal domicile in the canton Luzern (LU), Obwalden (OW), Nidwalden (NW), Schwyz (SZ), Zug (ZG), St. Gallen (SG), and Basel-Stadt (BS).

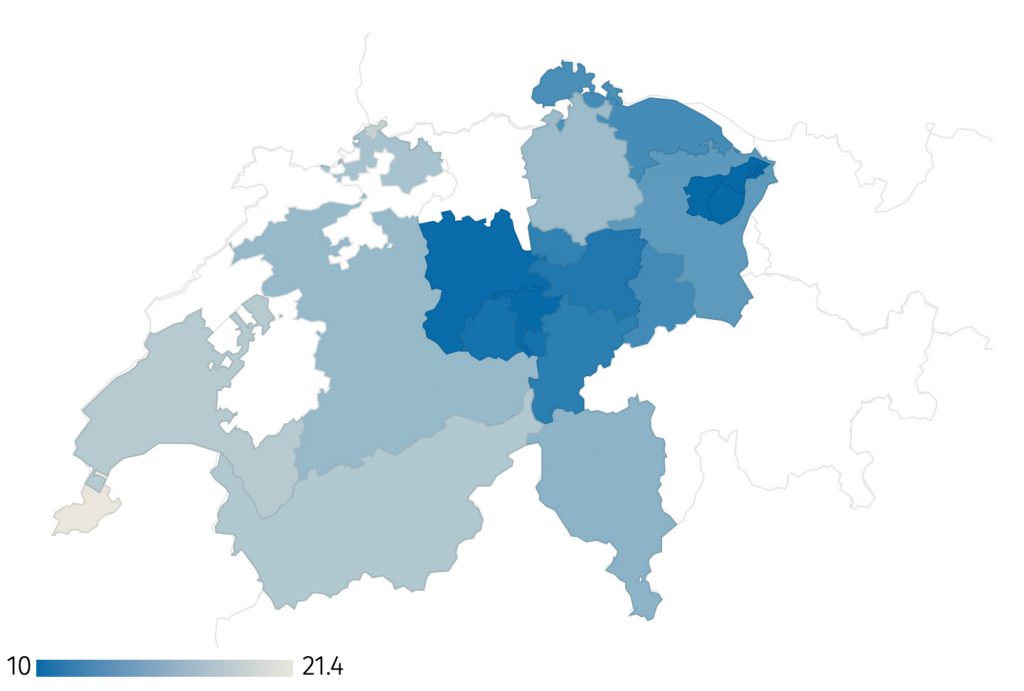

Note: Average tax burden (EATR) at the cantonal capital, in %. Source: BAKBASEL/ZEW, 2022

Note: Average tax burden (EATR) at the cantonal capital, in %. Source: BAKBASEL/ZEW, 2022

We are offering our services for legal domicile in the canton Luzern (LU), Obwalden (OW), Nidwalden (NW), Schwyz (SZ), Zug (ZG), St. Gallen (SG), and Basel-Stadt (BS).